14

HIRE AND RENTAL NEWS • FEBRUARY 2017

INDUSTRY in FOCUS

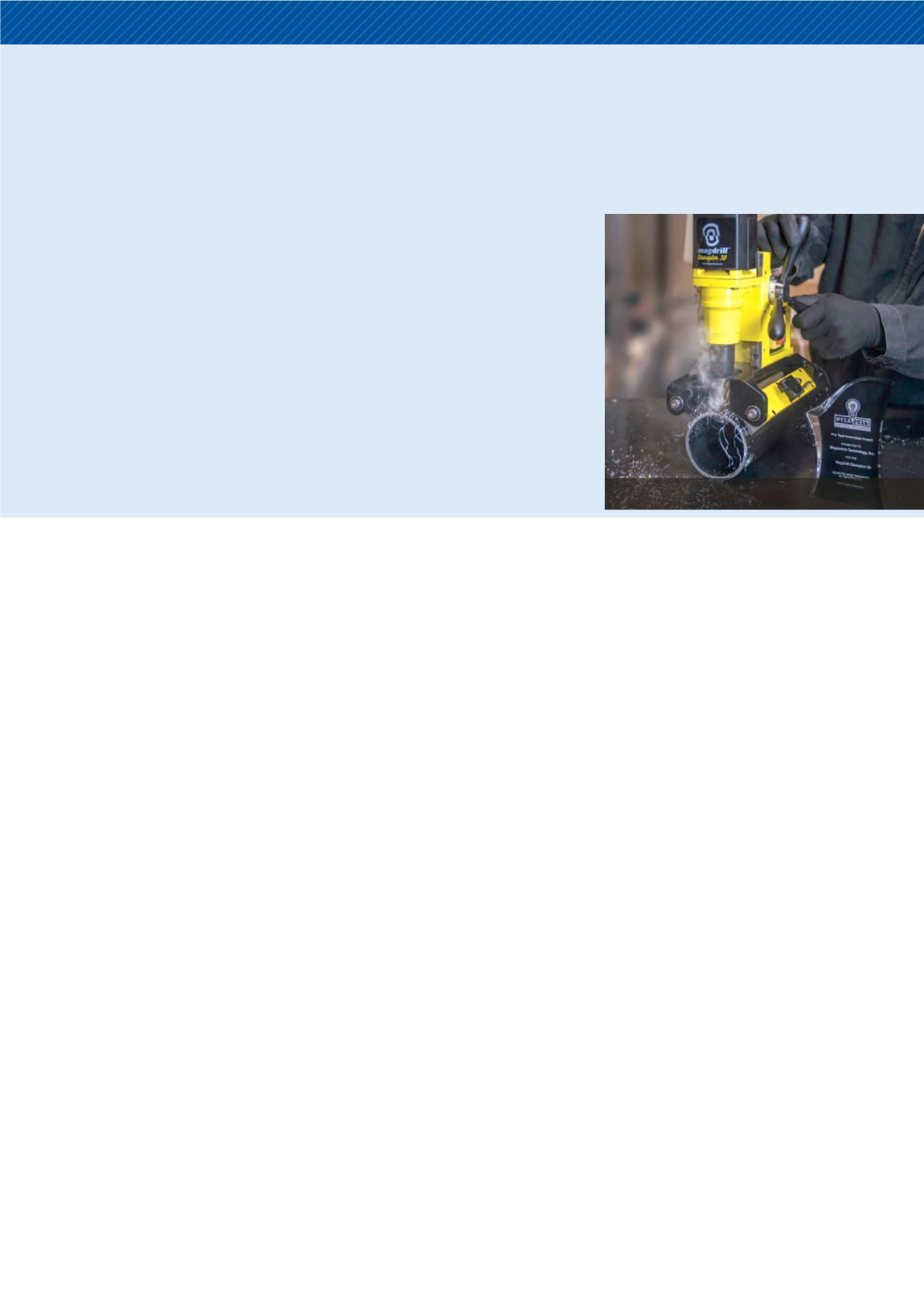

“Magswitch Technology was fortunate

enough to take out an award within the

‘Corded Power Tools’ category thanks to

our innovative and unique magnetic drill

press: the MagDrill Disruptor 30.

“This drill utilises patented shallow-

field magnetic technology that offers

an incredibly strong grip, even on steel

as thin as 1/8 inch. On top of this, the

patent-pending base automatically pivots

to conform to any pipe 3 inch or larger - a

feature that caught the judges attention

in a big way,” David said.

“Another contributing factor was

Breakthrough technology takes home international award

The 2016 Pro Tool Innovation Awards (PTIA) featured some incredible new industry

equipment, with each category boasting stellar competition, David Morton, CEO of

Australian company Magswitch Technology said.

the engineering behind the MagDrill

Disruptor 30s power distribution, since

no electricity is required for the magnets

to be effective. This means more power

goes to the motor, resulting in increased

efficiency and safety because the

magnetic grip will not be lost if there is a

sudden loss of power to the device.

“We are excited to receive such an

accolade for our flagship drill and thrilled

to announce the MagDrill Disruptor 30

is available in over 800 United Rentals

outlets across the US,” David said.

Visit:

www.magswitch.com.auMagswitch Technology won with its magnetic

drill press: the MagDrill Disruptor 30

Everything from telemetry helping

manage the health and ongoing cost

of your asset, safety, improved comfort,

functionality and overall performance

to rival the advances being made in the

automotive industry. All of this combined

with very low finance rates and a steady

market demand suggests investing in

these assets makes good business sense.

Rental rates are never guaranteed though

and there is always someone willing to

rent it out cheaper than ‘average’ rates

within your market. Three tips to assist

when investing in your fleet:

• Shop around. This may seem obvious

but many rental companies are

brand loyal and this can mean they

are paying more than they should,

as well as missing out on key items

such as longer service frequencies,

extended warranties or features such

as telemetry. Take the time to test your

preferred brand against the market.

You may still stay with ‘your’ brand,

however gain some additional benefits,

features or price points.

Has there ever been a better time to invest in

materials handling equipment for your rental fleets?

by Andrew Satterley

On the surface, investing in your equipment may seem like a large capital expenditure –

and it can be. However, the reality is whether it be forklifts, access equipment, cranes or

associated equipment, the cost has never been lower and the technology and features,

never better.

• Ensure you have a good asset

management system. One of the

largest investments for any business

is the operating system, and it is

the strength and capabilities of that

system that will play a significant

role in understanding, managing and

ensuring the return on your assets. You

must be able to manage the financial

aspects of the equipment, utilisation,

selling rates and overall profitability,

while also effectively managing the

running costs to maximise your return.

Finally, your system should bring the

asset management into the rental hub

(rental dockets, transport, mobility, etc)

and seamlessly link all the data. At

a glance, you should be able to view

profitability by individual asset and

your system should be your trusted ally

in determining future purchases.

• Exploring rental mobility functionality

is a must today and this should form an

integral part of your operating system.

• Funding. The time is right to broaden

your funding options beyond the

traditional banks. Interest rates are

at an all-time low, however, this is

not always reflected in the offerings

given to businesses looking to fund

capital expenditure. So test the market,

challenge the rates offered and look

outside the banks. The rates, term

and end financial position are all

key considerations and all can vary

depending on what model you wish

to adopt or what model a particular

institution wants to offer. Being diligent

here can increase your return for the

life of the asset as well as return on

disposal at life end.

In summary, some parts of the economy

have cooled, however, most states are

experiencing consistent investment in

building and construction and with low

interest rates and low cost of equipment

the time is right to invest in your fleet.

The key is to invest smart, challenge

traditional decisions and see what the

market can do for you.

Contact: 1300 837 142 or visit website:

www.baseplan.com