19

HIRE AND RENTAL NEWS • MAY 2016

need cover for complete theft, from anywhere, anytime.

“We can’t keep taking the hit for customers. Because every time

we claim against our insurance policies, our premiums go up as

a result.”

The way Jarrod sees it, three things need to happen:

"We need to make hire members aware their customers are

probably not covered for theft or negligent damage to equipment;

"We need to make our customers aware they are probably not

covered for theft or negligent damage to equipment;

"We need to talk to the insurance industry to say: 'we’ve got this

problem'.

"Here are some questions we need to ask our insurance

companies:

"If I have hired gear in my possession and I roll it and damage it,

what would happen?

"If equipment is stolen from my driveway what happens? Am I

covered for theft in this instance;

"If equipment on hire is stolen from my shed: would I be

covered?

“What should be happening is insurance brokers should be

advising their construction industry clients they need insurance

to cover their use of hire equipment.”

Jarrod is being proactive and has been working with AJ

Gallagher to produce a letter to his customers explaining they

need to be adequately covered when hiring equipment.

“Customers need two options to be adequately covered: to

address care custody and control or, to attach their additional

hire equipment insurance to their motor vehicle policies.

Customers need to have a sub limit of the most expensive item

they hire so if that is a 1.5 tonne excavator it would be say

$50,000. If it was a 60ft boom then it would be $150,000 and so

on."

Jarrod sent out 600 letters to his customers advising of this

discrepancy in damage waiver insurance coverage.

He had a 5% response.

“I was disappointed by my customers' reaction. Some said they

had adequate coverage; we had some customers asking what we

were talking about; and a few didn’t have any insurance at all.

“As a hire company we want to try and avoid customers that

might end up costing us big dollars in increased premiums.We’re

trying to educate people about their requirements, to help them.

Ultimately, we don’t want to see customers disadvantaged.

“We are a hire company, not an insurance company. Is it our duty

to sell the hirer the insurance?”

Visit: www.kerrshire.com.au

INDUSTRY in FOCUS

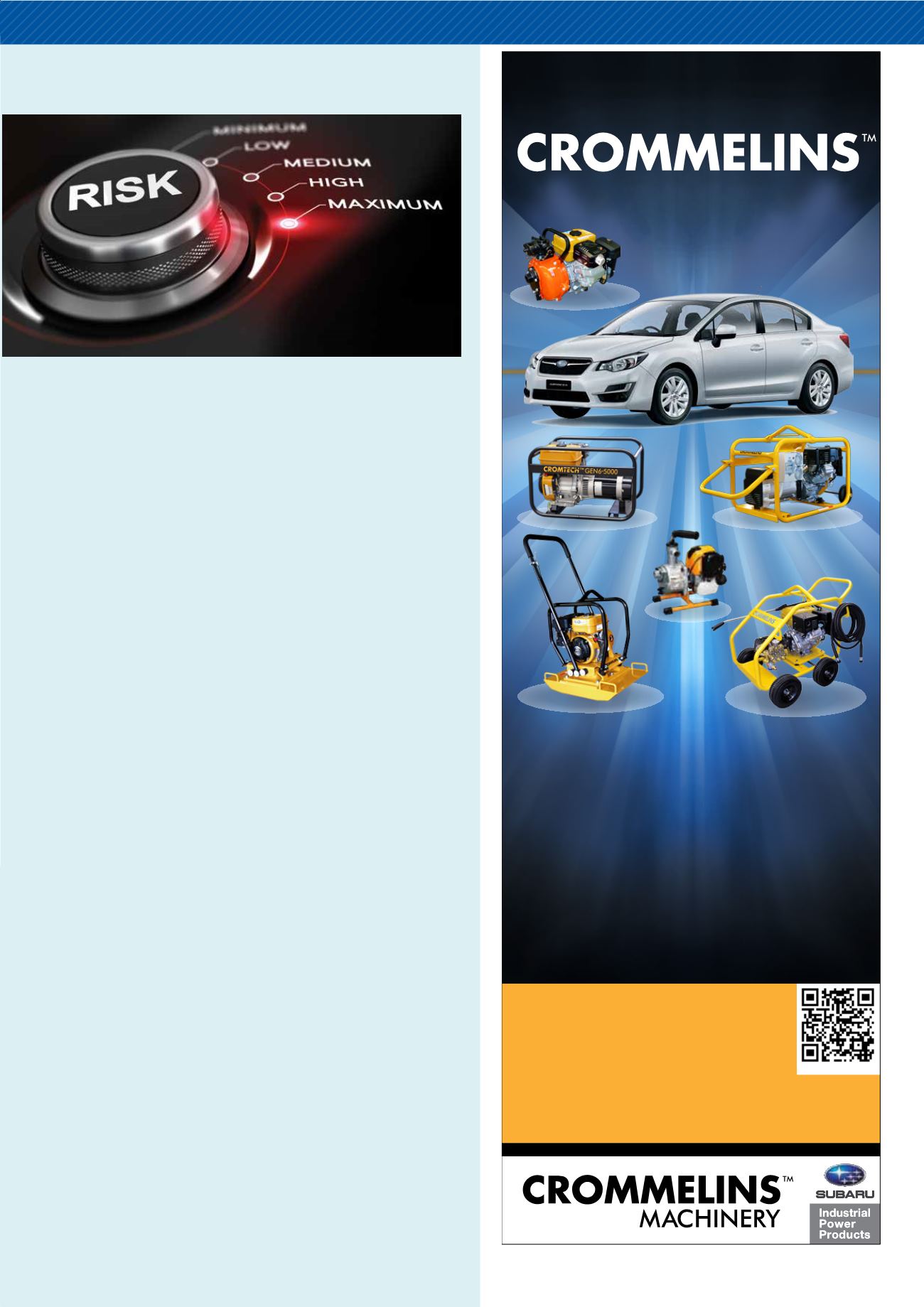

SUBARU PRODUCTS

&

WIN

*

CHOOSE

CHOOSE CROMMELINS SUBARU & WIN! promotion runs from 1/4/2016

to 30/6/2016. Drawn: 15/7/2016. How: Purchase a new CROMMELINS™

branded or CROMTECH™ branded product, powered by a genuine

Subaru Industrial Engine to be eligible to enter the draw.

Prize: A SUBARU Impreza 2.0i CVT Auto (including dealer costs) valued

at $24,990rrp. The prize is not transferable or redeemable for cash or

any other product. Proof of purchase is required to claim your prize.

Eligibility:

Entrants must be 18 years or over and an Australian resident

to enter the draw. This promotion is open to Crommelins authorised

dealers/resellers and their retail customers (end-users) and Crommelins independent hire

customers. It excludes Crommelins OEMs, Crommelins Machinery employees and their

immediate families. Permit Nos: NSW Permit No. LTPS/16/00082, ACT Permit No. ACT TP

15/08472, SA Permit No. T16/19, (WA, VIC, NT & QLD not required). Promoter: Crommelins

Operations Pty Ltd trading as Crommelins Machinery. ABN 11 008 889 656. 139 Welshpool

Road, Welshpool WA 6106. Phone (08) 9350 5588.

*Full terms and conditions,

go to www.crommelins.com.au/carpromo

SUBARU IMPREZA

WORTH

$24,990!

BUY A CROMMELINS™

BRANDED PRODUCT

POWERED BY A GENUINE

SUBARU AND RECEIVE AN

ENTRY TO WIN A

SCAN CODE FOR INFO