PPSR mistakes which may invalidate security

By Malcolm Poslinsky, Director – Brilliant Credit Management

Imagine going to enforce your registered security interest against an insolvent customer,

only to find a defect in your PPSR registration limits your security. Worse still – imagine if

your security were completely invalidated due to a simple error.

Then imagine auditing all your other

registrations to check whether the

defects have been repeated. Finally,

imagine the daunting task of processing

amendments or new registrations on to

the PPSR to put it all right.

This is not a fanciful scenario. The rules

for registration are very complex, and

insolvency practitioners are becoming

skilled at exploiting seemingly minor

defects for their own ends.

EDX has completed over 100 compliance

reviews or remediation projects to ensure

the best chance of success when it

comes to enforcement. We have identified

some dominant themes.

Over the course of completing

compliance reviews and remediation

projects for organisations already

registering on the PPSR, we have

discovered common defects that may

limit or invalidate registered security

interests. Our formal engagements have

covered the banking; non-financial

institutions; retention of title suppliers

and the hire industry.

The incidence of error has been

alarmingly high and our initial conclusion

was every possible mistake that could

have been made has been made. Closer

examination did however reveal some

overarching themes. The table below

highlights the most important of these,

with the likely consequence of the error.

The register has now been operative

for four years. In view of the level of

error we have discovered, we suggest

every organisation which registers on

the PPSR should conduct an audit of its

registrations. Of course, that is easy to say

– but a daunting prospect without help.

We have developed a suite of services to

minimise the pain and disruption of the

audit and more importantly, to ensure

future registrations are processed in a

PPSA-compliant manner.

The services include:

• ‘Desktop’ compliance review. This is

a high-level review of a small number

of financing statements and terms of

trade, designed to uncover obvious

errors which may extend across a

portfolio of registrations. There is no

charge for this review;

• Full compliance review. This gets down

to detail. We retrieve all registrations

from the PPSR and apply analytical

techniques to identify errors or

registrations which require further

investigation. Fees are volume-driven

and discussed ahead of the assignment;

• Remediation. This is the processing

of amendments, new registrations

(and where applicable – discharges)

to correct errors in the full compliance

review. Fees are volume-driven and

discussed ahead of the assignment;

• New registrations and registry

maintenance. We consider the volume

and complexity of registrations,

together with in-house resources and

recommend the most effective way to

process new registrations and attend

to registry maintenance. If this service

is provided in conjunction with the full

compliance review and remediation,

there is no further charge for this report.

This information is most appropriate for

organisations registering to protect their

interests. It is also relevant to:

• Organisations (and their solicitors)

acquiring businesses which register on

the PPSR to protect their interests. An

important part of due diligence may be

to ensure the target’s registrations are

PPSA-compliant. We can work with the

acquirer’s solicitors here;

• Organisations that register on the

PPSR and are preparing for sale. A

demonstration of PPSA compliance

may not increase the price, but it can

ease the passage of the deal.

Contact 03 8820 5018.

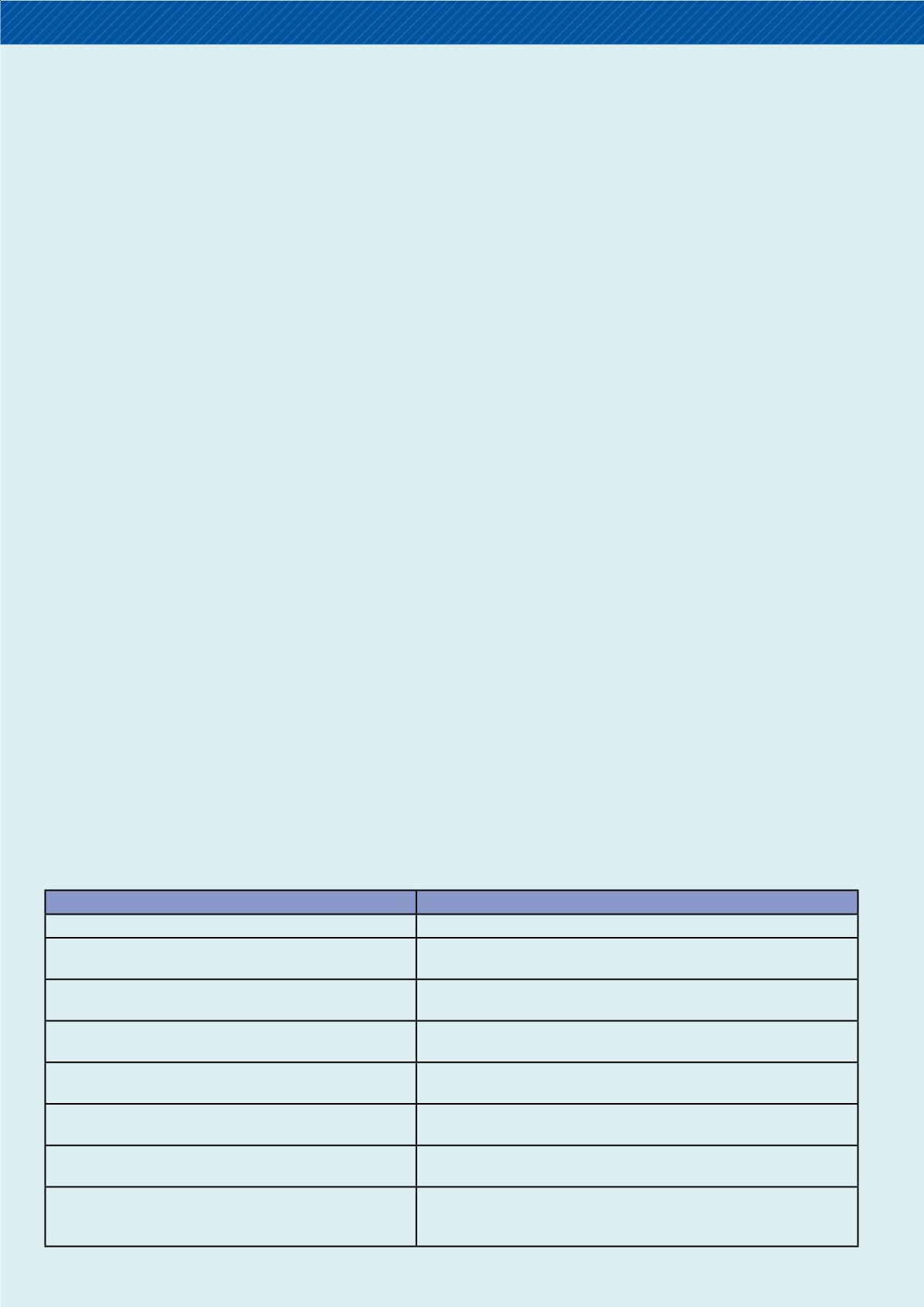

Error

Likely Consequence

Claim a security interest is transitional when it is not.

Registration will be ineffective.

Claim a Purchased Money Security Interest (PMSI) when

there is none.

Registration will be ineffective.

Fail to claim a PMSI when the security interest is a PMSI.

The super priority of the PMSI will be lost and priority will be

determined by other rules (most often the first to register).

Registration of PMSIs outside of specified time limits.

The super priority of the PMSI will be lost and priority will be

determined by other rules (most often the first to register).

Registration of security interest more than 20 business

days after the security agreement was created.

Registration will be set aside if the grantor becomes insolvent within

six months of the date of registration.

Error in the serial number of a serial numbered good (most

often a motor vehicle).

Registration will be ineffective.

Selection of incorrect collateral class.

Registration may be ineffective – or will be ineffective if a serial

numbered good has been registered under the wrong collateral class.

Failure to identify grantor in the required manner (eg –

using company name or ABN instead of the required ACN,

and/or the treatment of trading trusts).

Registration will be ineffective.

INDUSTRY in FOCUS

16

HIRE AND RENTAL NEWS • MAY 2016